Choose your mode of usage

Hassle-free

repayment of dues

Pay through auto-debit mandate, UPI, NEFT, IMPS, and BBPS.

ICICI PayLater can be used across

many categories of merchants*

*PayLater is available on select merchants only. Merchants may reject transactions as per their internal policy.

To keep your PayLater Account secure and ensure that you receive important updates, please update your mobile number and e-mail ID correctly in the account.

This also enables you to:

- Receive instant alerts

- Receive real time updates on your transactions

- Be notified if any suspicious or unauthorised transactions are carried out on your PayLater

- Receive updates on new promotions, personalised offers etc.

- Credit Information Companies (CICs) shall send alerts through SMS/ email when your Credit Information Report (CIR) is accessed

- Receiving alerts from the Bank whenever DPD in their existing account is reported by the Bank to CICs

PayLater FAQs

Why is ICICI Bank discontinuing the PayLater facility?

ICICI Bank is discontinuing the PayLater facility as per its internal policy revisions from 8th May 2025 11:59 P.M. IST.

When will PayLater transactions stop?

You will not be able to carry out any transactions using PayLater from 8th May 2025 11:59 P.M. IST.

What will happen to my pending dues?

All outstanding dues must be cleared as per the existing repayment schedule, either through Auto Debit or the iMobile app/Retail Internet Banking. Late payments will attract penalties, as per the PayLater Terms & Conditions. Post clearance of all the dues, the Bank will close your PayLater Account.

Invest Anywhere,

Anytime

Mobile Banking | Net Banking

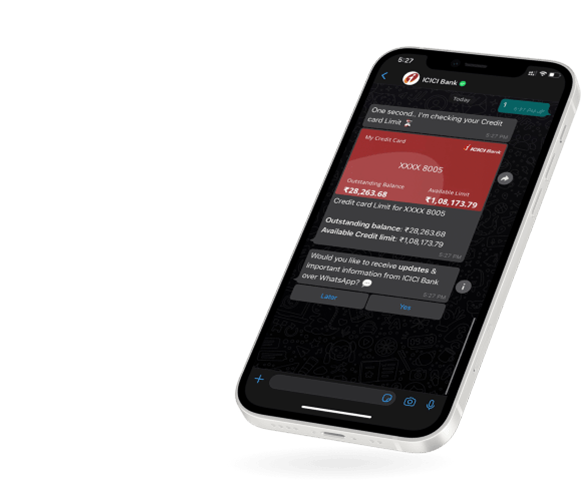

WhatsApp Banking