How to activate

ICICI PayLater?

- 01.Log in to ICICI Bank Internet Banking or iMobile Pay

- 02.Check your PayLater offer under ‘Pre-approved Loans/Offers’ section

- 03.Click on ‘Activate Now’

- 04.Start using your PayLater credit line!

Choose your mode of usage

Hassle-free

repayment of dues

Pay through auto-debit mandate, UPI, NEFT, IMPS, and BBPS.

ICICI PayLater can be used across

many categories of merchants

To keep your PayLater Account secure and ensure that you receive important updates, please update your mobile number and e-mail ID correctly in the account.

This also enables you to:

- Receive instant alerts

- Receive real time updates on your transactions

- Be notified if any suspicious or unauthorised transactions are carried out on your PayLater

- Receive updates on new promotions, personalised offers etc.

- Credit Information Companies (CICs) shall send alerts through SMS/ email when your Credit Information Report (CIR) is accessed

- Receiving alerts from the Bank whenever DPD in their existing account is reported by the Bank to CICs

PayLater FAQs

What is ICICI Bank PayLater facility?

ICICI Bank PayLater is a pre-approved Credit Line on UPI. Customers can check their offer eligibility under ‘Pre-approved Loans/Offers’ section on iMobile Pay. Customers can also check the eligible offers through Net Banking in the ‘Offers’ section and avail the required offers in just one click.

How can I get the PayLater facility?

ICICI Bank PayLater facility is available to customers on an invitation basis only. Customers for whom the facility is available can activate it using iMobile Pay or Internet Banking:

iMobile Pay > Pre-approved Loans/Offers > PayLater > Activate Now

Internet Banking > Log in > Apply Online > Offers for you > PayLater > Activate Now

What is the limit offered in ICICI Bank PayLater?

The limit of your PayLater Account can range between Rs 7,500 to Rs 50,000, based on your eligibility. The limit is already set for the customers to whom the invite is sent.

Invest Anywhere,

Anytime

Mobile Banking | Net Banking

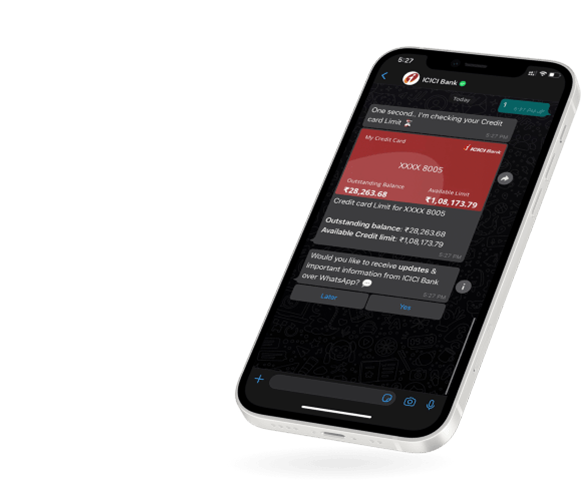

WhatsApp Banking