Features of PPF Account

More reasons to choose ICICI Bank’s PPF

Eligibility Criteria and Documents Required

Open a Public Provident Fund

Account Online Instantly!

Process to transfer existing PPF Account to ICICI Bank

You can transfer your existing PPF Account from your current authorised bank or Post Office to ICICI Bank by following the below steps:

Rules & Charges about PPF Withdrawal

Partial Withdrawals

You can do partial withdrawals after completing 5 financial years of holding an active PPF Account. The maximum amount you can withdraw is the lower of the following two options:

50% of the balance in the Account at the end of the 4th financial year preceding the year of withdrawal; OR

50% of the balance in the Account at the end of the year prior to the withdrawal year

Only one withdrawal is permitted every financial year.

Complete Withdrawal

After the lock-in period of 15 years is completed, you can withdraw the full amount in your PPF Account.

PPF Withdrawal Charges

For early withdrawal before the lock-in period is completed, a penalty is levied of 1% reduction in the interest applicable for the period for which the Account is held. For example, if the interest rate is 7.1% per annum for five years before you make a withdrawal, the interest for each year will be reduced to 6.1%.

Public Provident Fund: Limits and other important features

The minimum and maximum amount that can be deposited in every financial year is ₹ 500 and ₹ 1,50,000, respectively.

The loan facility is accessible from the third to the sixth financial year.

Withdrawals are permitted once a year starting in the sixth financial year.

The complete PPF maturity amount is allowed to be withdrawn after the end of the lock-in period.

Extension of the PPF Account after the initial 15 years is allowed in 5-year increments, with or without deposits. The Account continues to earn interest even when you extend without additional deposits.

No court order can take money out of the Account.

Under Section 10 of the IT Act, interest generated is tax-free and deposits are eligible for deduction under Section 80C.

Only a single PPF Account can be opened under an individual’s name.

No joint PPF Account can be opened.

Public Provident Fund FAQs

When can I view my PPF Account online after account opening?

You can view your PPF Account online 24 hours after the Account is opened.

What is the maximum period for which I can set up a Standing Instruction?

A Standing Instruction can be set up for 15 years or till the maturity of PPF Account.

Can I get tax benefit on my PPF investment?

Yes, you can avail tax benefits with PPF. The deposits made in your PPF Account can be claimed as tax deductions under section 80C. The interest accrued is tax-free.

Invest Anywhere,

Anytime

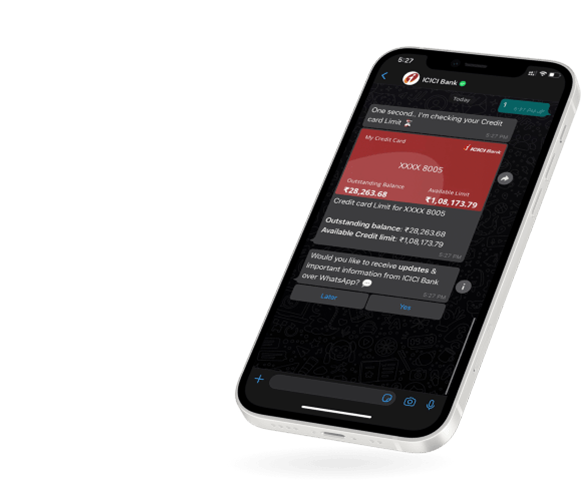

Mobile Banking | Net Banking

WhatsApp Banking