Why use FlexiCash?

Calculate your Interest

- ₹0

- ₹10L

- 12.35%

- 14.10%

- 1 Day

- 30 Days

₹10,026*

Processing & Renewal fees start at ₹1,999

ROI: Between 12.35% and 14.10% per year

How to avail FlexiCash?

Personal Loan Eligibility Criteria

FlexiCash FAQs

Restriction on using the OD funds

As per the Reserve Bank of India guidelines and Bank’s policy, Overdraft funds extended to the customer shall only be used for the intended purpose(s) as per the terms of sanction. The Overdraft funds shall not be used for any transaction/activity which is prohibitive in nature. In case the Overdraft funds are used for any prohibitive transaction/activity, ICICI Bank reserves the right to take appropriate action as deemed fit by the bank, which may include freezing of the Overdraft account or its closure.

Utilising Overdraft funds for the following purposes is considered prohibitive:

- Investing in real estate

- Lottery

- Gaming

- Digital currency/coin

- Gambling

- Betting

- Chit fund financing or any other speculative activity

- Purchasing gold, jewellery, gems

- Investing in stock market, mutual funds, F&O, market-driven bonds, funds and chits

- Repayment of any credit facility such as Loan, Credit Card, OD facility etc.

Customers will be informed about the usage of Overdraft funds for prohibitive activity/transaction and will be asked to credit back the amount used for unintended purposes.

Failing to adhere to the abovementioned end usage of Overdraft funds will result in freeze or closure of account.

What is FlexiCash?

ICICI Bank customers are selected basis their banking relationship with us, in addition to other parameters, and offered a pre-approved overdraft limit on their Salary Account. This limit can be utilised from Salary Account to honour cheques/ EMI at ATMs and Point of Sale (POS).

How do I repay the FlexiCash?

The amount payable will be auto-swept as and when sufficient balance is available in your Salary Account.

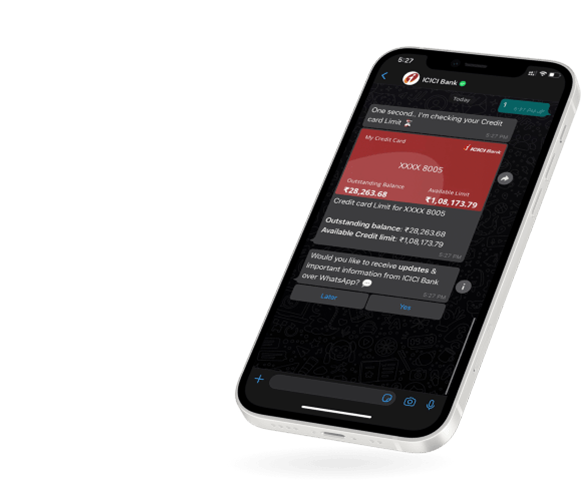

Apply for loans at

your convenience

- Mobile Banking

- Net Banking

- WhatsApp Banking

Apply for loans at

your convenience

Mobile Banking | Net Banking

WhatsApp Banking