Want to book a recurring deposit with us?

- 01. Select the language you prefer.

- 02. Press ‘1’ if you’re an existing customer.

- 03. Press ‘1’ for banking accounts.

- 04. Enter the number and the PIN of your debit card to speak to our customer care executive

- 01. Visit the branch of ICICI Bank that’s nearest to you

How to Create RD on iMobile

How to Create RD on Internet Banking

iWish Goal Based Savings

No penalties for missed payments

We understand that sometimes, life can get very busy. And missed payments may happen. With iWish, you need not worry about missing your RD instalments because there’s no penalty involved.

Start with small amounts, experience the advantage of goal-based savings and enjoy the benefits of iWish, the smarter deposit. Want to know more? Simply click the button below.

Documents required for creating a RD

Recurring Deposit FAQs

What is a recurring deposit?

ICICI Bank’s recurring deposit (RD) is an ideal way to invest small amounts of money every month and end up with a large kitty on maturity.

Is the interest earned on my recurring deposit taxable?

For recurring deposits, tax is deducted on accrued interest, if any, on September 30 and March 31 every year and on maturity.

What is the minimum and maximum tenure for recurring deposits with ICICI Bank?

With our RDs, make deposits for a minimum period of six months and thereafter, increase your investment tenure in multiples of three months. The maximum tenure for holding a recurring deposit with us is 10 years.

See how easy it is to get Recurring Deposit ! Watch Now

Invest Anywhere,

Anytime

Mobile Banking | Net Banking

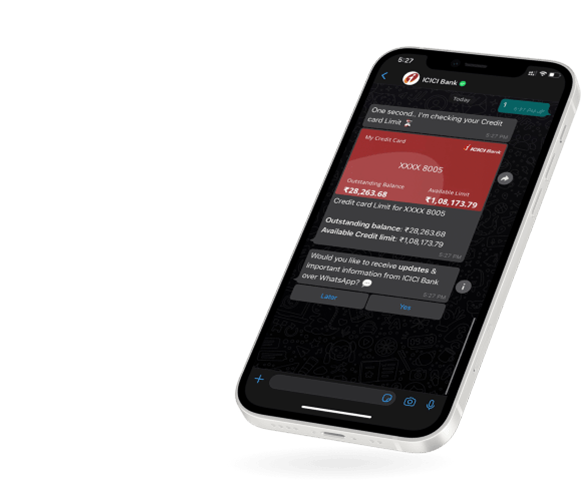

WhatsApp Banking