Benefits of linking other Bank accounts with ICICI Bank iFinance

Enhance your banking experience with iFinance

Discover Financial Insights

Summary of category-wise spending

Analysis of daily inflows, expenses and balances

Top 5 Debit, Credit & Merchant transactions

How to Activate iFinance?

Link All Bank(s) accounts | ICICI Bank Introducing iFinance| iMobile Pay App

Link All Bank(s) accounts | iFinance | ICICI Bank Internet Banking

iFinance FAQs

What is iFinance?

iFinance is a feature that helps in conveniently viewing all your bank accounts at one place and it is available on various digital platforms of the Bank such as Internet Banking and iMobile Pay app (for both individual and self-employed segments). It is powered by our Account Aggregator Technical Service (through Financial Information Providers or FIPs), which lets you fetch and view the information of all the Accounts linked to your registered mobile number, held with other banks as well. iFinance offers a comprehensive view of the bank balances, top spending and income categories, expenses, expense breakdowns, daily inflows, etc.

Why should I connect my other bank Accounts to my ICICI Bank app?

It has been a challenge for customers to visit different banks’ branches or navigate through different banking apps to access Account related information. iFinance brings you a one-stop digital solution to get a consolidated view of all your Bank Accounts and balances, in a single window. It also offers a summary and analysis of your income and expenses, where and how you have spent money from all your Accounts. This helps you exercise better control over your transactions and monitor your finances seamlessly.

Is my financial data safe after linking my different bank accounts to iFinance?

Yes, we prioritise the security and privacy of your financial data. As one of the leading Banks, we follow industry-leading security standards to protect your data.

Related Videos

Banking

at your convenience

Mobile Banking | Net Banking

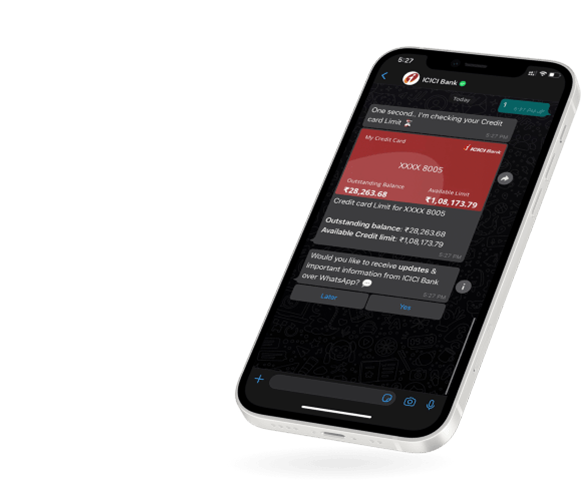

WhatsApp Banking