Disclaimer*: Our Personal Loan EMI calculator offers estimated monthly installments which are indicative, tentative and are based on the details entered by the user. Actual loan terms and eligibility are subject to bank approval. For precise loan details, consult our representatives before decisions based on these estimates.

Personal Loan: Benefits & Features

Personal Loan Interest, Documents & Eligibility

Multi-Purpose Personal Loan from ICICI Bank

Popular Personal Loan FAQs

What is a Personal Loan?

A Personal Loan is an unsecured loan to obtain funds for financial expenses such as house renovation, wedding, education, medical bills, travel etc. These loans offer competitive interest rates and flexible tenure options, allowing borrowers to repay in monthly instalments (EMIs) without needing to provide collateral. You can check your Personal Loan EMI amount with our Personal Loan EMI calculator.

What are the documents required for a Personal Loan with ICICI Bank?

For Salaried Individuals:

1. Proof of Identity/Residence: Any one of the below Official Valid Documents (OVD) can be accepted as Current / Communication address proof only.

Passport

Driving License issued by Regional Transport Authority

Voter's Identity Card issued by the Election Commission of India

Letter from National Population Register containing details of name and address

Proof of possession of complete AADHAR Card

NREGA Card.

2. Latest 3 months* Bank Statement (where salary/income is credited)

3. Salary slips for the last 3 months*

B. For Self-Employed:

1. Proof of Identity/Residence: Any one of the below Official Valid Documents (OVD) can be accepted as Current / Communication address proof only.

Passport

Driving License issued by Regional Transport Authority

Voter's Identity Card issued by the Election Commission of India

Letter from National Population Register containing details of name and address

Proof of possession of complete AADHAR Card

NREGA Card

2. Income Proof :

Audited financials for the last two years

Latest 6 months* Bank Statement

3. Office address proof

4. Proof of residence or office ownership

5. Proof of business continuity.

*Conditions applied as per policy.

*ICICI Bank reserves the rights to call upon additional documents at its discretion.

Do I need to provide a security or collateral to apply for a Personal Loan with ICICI Bank?

No, ICICI Bank offers its customers a collateral-free Personal Loan without any security. Visit our website to apply for an instant Personal Loan online.

Other types of Personal Loans

Apply for Personal Loan

Online at Your Convenience

- Mobile Banking

- Net Banking

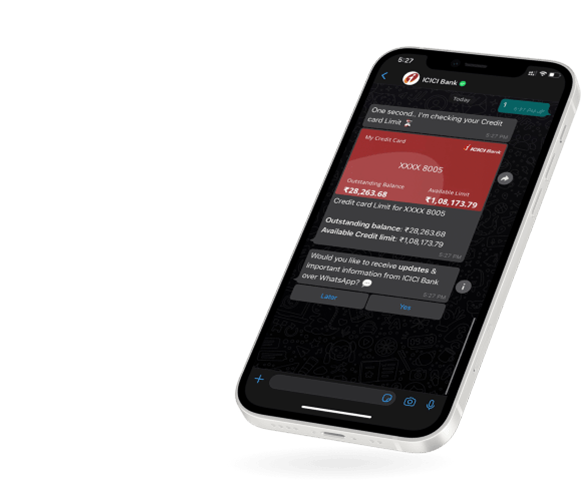

- WhatsApp Banking

Apply for Personal Loan

Online at Your Convenience

Mobile Banking | Net Banking

WhatsApp Banking

Never leave your dreams hanging!

Get a Personal Loan now with minimum documentation.