- ₹30,000

- ₹40 Lakhs

- ₹0

- ₹40 Lakhs

- 12 Months

- 72 Months

You are eligible for a total

loan amount of Rs

Disclaimer*: The information provided is not guaranteed to be accurate or complete and is indicative and tentative in nature. Users are advised to exercise caution and seek professional advice before making decisions based on it. ICICI Bank bears no liability for updating the data or for any losses arising from the use of this information.

Personal Loan Eligibility Criteria

Personal Loan eligibility FAQs

What is a Personal Loan eligibility calculator?

A Personal Loan eligibility calculator is an online tool that helps individuals to be aware of the maximum eligible amount for a Personal Loan. It is calculated based on a few factors like income, tenure (of the loan amount) and existing financial obligations.

Note Individual CIBIL score might impact the maximum eligibility amount.

How to use a Personal Loan eligibility calculator?

To use a Personal Loan eligibility calculator, enter your personal and financial details such as income, expenses, existing loans and tenure. The calculator will analyse your eligibility and estimate the loan amount you may qualify for. Based on this, an individual can apply for a loan, as required.

What are the factors that determine Personal Loan eligibility?

For salaried applicants, the Personal Loan eligibility depends on their age, net salary, years of professional experience and duration of residence at the current address. Self-employed individuals are assessed based on their age, minimum turnover, minimum profit after tax, business stability and existing relationship(s) with ICICI Bank. These criteria collectively determine the eligibility for a Personal Loan, ensuring a thorough financial stability and credibility evaluation. Lastly, the applicant’s credit score may also be considered.

Note Eligibility criteria can change as per RBI guidelines.

Personal Loan Eligibility Blogs

Apply for Personal loan

at your convenience

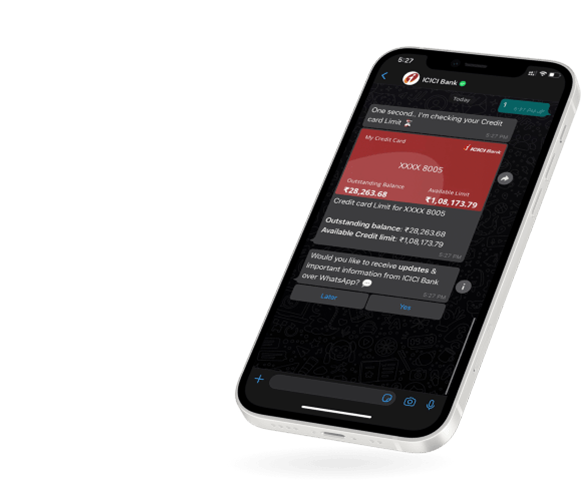

- Mobile Banking

- Net Banking

- WhatsApp Banking

Apply for Personal loan

at your convenience