Home Loan Calculators

Calculate your monthly EMI

₹32,178*

₹20,00,000

₹7,02,965*

₹27,02,965

*For representation purpose only. Final values may vary subject to bank’s policy.

Calculate your monthly EMI

*For representation purpose only. Final values may vary subject to bank’s policy

₹ 13,80,308

₹ 14,000

*For representation purpose only. Final values may vary subject to bank’s policy

- ₹5L

- 50L

- 1CR

- 1.5CR

- 2CR

- 2.5CR

- ₹3Cr

- 1

- 21

- 12

- 360

- 1%

- 21%

- 12

- 360

Monthly EMI

You Save ₹0/month

Total Amount Paid

- ₹0

- 10L

- 20L

- 30L

- 40L

- 50L

- 60L

- 70L

- 80L

- 90L

- ₹1Cr

- ₹10k

- 10L

- 20L

- 30L

- 40L

- 50L

- 60L

- 70L

- 80L

- 90L

- ₹1Cr

- ₹0

- 10L

- 20L

- 30L

- 40L

- 50L

- 60L

- 70L

- 80L

- 90L

- ₹1Cr

- 0%

- 15%

- 1

- 30

₹ 2,32,000

₹ 1,32,000

₹ NaN

₹ NaN

*Subject to CIBIL Score and Loan Amount

Home Loan Eligibility

Determining your eligibility for a Home Loan is crucial before initiating the application process. This eligibility table will outline the key factors lenders consider, including income, credit score, employment status, age and property value, helping you assess your likelihood of approval and plan your home purchase journey effectively.

Criterion |

Details |

|---|---|

Profession |

Both salaried and self-employed individuals are eligible for a Home Loan |

Income |

|

Age |

21 years - 70 years |

Loan Amount |

No upper cap, loan amount sanctioned depends on your eligibility. You can apply for a Home Loan of up to ₹ 5 crore while applying online |

Nationality |

Indian citizen |

Home Loan Interest Rates & Charges

Explore Home Loan Interest Rates and Charges with the table given, outlining the costs and rates involved in securing your home financing.

Special Home Loan Interest Rates

Special Home Loan interest rates, often lower than standard, are offered for a limited time or to eligible customers, serving as incentives or promotional offers. Below are the special Housing Loan interest rates:

CIBIL |

Salaried |

Self-Employed |

|---|---|---|

>800 |

9.00% |

9.00% |

750-800 |

9.00% |

9.10% |

Standard Home Loan Interest Rates

Standard Home Loan interest rates apply uniformly to all applicants, determined by market conditions and creditworthiness. Below are the standard Housing Loan interest rates:

Loan Slab |

Salaried |

Self-Employed |

|---|---|---|

Up to ₹ 35 lakhs |

9.25% - 9.65% |

9.40% - 9.80% |

₹ 35 lakhs to ₹ 75 lakhs |

9.50% - 9.80% |

9.65% - 9.95% |

Above ₹ 75 lakhs |

9.60% - 9.90% |

9.75% -10.05% |

The Home Loan interest rates mentioned above will vary basis parameters such as the Bureau Score (credit score), Customer Profile, Segment etc.

The above rates are linked to the Repo rate

The processing fee is 0.50% of the loan amount, plus applicable taxes

The interest rates mentioned above are valid till 31st Mar, 2025

Documents required to apply for a Home Loan?

Below is the list of documents required for a Mortgage Loan based on profile:

Individuals:

Identity Proof & Address Proof of Individuals: Aadhaar/Passport/Driving License/Voter ID/National Rural Employment Guarantee Act (NREGA) Card/Letter from the National Population Register (NPR) containing details of your name and address.

DOB Proof: Passport/Driving License/Voter ID/NREGA Card/Letter from the NPR containing details of your name and address.

Non-Individuals (Entity):

Identity Proof: Registration Certificate including Udyam Registration Certificate (URC) issued by the Government/Certificate/License issued by the municipal authorities under Shop and Establishment Act/Sales and Income Tax returns/CST/VAT/GST Certificate/Certificate/Registration document issued by Sales Tax/Service Tax/Professional Tax authorities/ IEC (Importer Exporter Code) issued to the proprietary concern by the office of the Directorate General of Foreign Trade (DGFT)/License/Certificate of practice issued in the name of the proprietary concern by any professional body incorporated under a statute/Complete Income Tax Returns (not just the acknowledgement) in the name of the Sole Proprietor where the firm's income is reflecting, duly authenticated/acknowledged by the Income Tax authorities/Utility bills such as electricity, water, landline telephone bills etc.

Note: For sole proprietorship concerns, any of the above-mentioned two documents are required.

Address Proof: GST Certificate/Business Registration Certificate/Gumastaa License/Udhyam Registration Certificate/Bank statement (not to be considered for entity proof)/Utility Bill/ITR/Rent Agreement with utility bill within 2 months.

Note: If the registered address and permanent address of the entity are different – proof is required in both cases.

Apart from the above-mentioned document, additional documents will be required for the below entities:

Partnership Firm: Partnership Deed

Limited Liability Partnership: LLP Agreement and Certificate of Incorporation, List of designated partners and latest profit-sharing ratio certified by a Chartered Accountant (CA)/Company Secretary (CS)

Public & Private Limited Co. (Even if there is only 1 director): Certificate of Incorporation, Memorandum of Association (MOA) and Articles of Association (AOA), CA/CS certified latest list of Directors and Shareholders with their names, date of birth, nationality and address

Trust: Trust Deed with Registration Certificate, list of all beneficiaries, trustees, settlors, protectors and authors of the trust, containing their names and Date of Birth

Society: By-laws/Memorandum of a Society with Registration Certificate, list of members with their names, address and Date of Birth

HUF: List of Adult Coparceners (Joint Heirs) attested by the Karta (Head of the family)

Authorised signatory along with KYC and Relationship Segment details in case of Private/Public Limited Companies/Limited Liability Partnerships/Partnership Firms/Trust/Society

List of Directors and Senior Management details in case of Private/Public Limited Companies

Legal Entity Identifier (LEI) Certificate of non-individual borrowers having a banking system exposure of ₹ 5 crore and above.

Beneficial owner details along with KYC documents as per below:

In case of Company/Partnership Firms/Limited Liability Partnership, more than 10% of shares/capital/profit of the company

In case of Unincorporated Association or Body of Person/Individual, more than 15% of capital/profit of the company

In case of author of the trust, the trustee, the beneficiaries with 10% and more interest in the trust.

Below is the list of documents required for a Mortgage Loan based on employment:

Income Proof:

Salaried:

Latest Form 16

Latest one-month salary slip

Bank statements of the last 6 months.

Self-Employed

Last 6 months’ Bank statements of all operative accounts

Last 2 years CA Certified/Audited Income Tax Returns (ITR), computation of income, Profit and Loss Account Statement and Balance sheet

GST returns of the last 1 year.

Disclaimer This is an indicative list only. Additional documents may be required for a case-to-case basis.

Get a Mortgage Loan in just 5 steps

- 01.Enter your basic details

- 02.Check your eligibility

- 03.Pay the processing fee

- 04.Upload Documents

- 05.Get Provisional Sanction

ICICI Bank Home Loan Features & Benefits

Maximising Your Home Loan Approval: Dos and Don'ts

| Dos | Don'ts |

|---|---|

Investigate loan and property details thoroughly. |

Avoid applying for a Home Loan on multiple aggregator sites to maintain approval chances. |

Plan for unexpected expenses wisely. |

Refrain from carrying excessive loans to maintain a favourable creditworthiness. |

Keep all necessary paperwork organised. |

Avoid overspending on Credit Cards or delaying loan repayments to prevent a negative impact on your credit score. |

Improve your credit before applying for a Home Loan. |

Don't commit to a Home Loan beyond your means to ensure manageable repayments. |

Home Loan FAQs

What is a home loan?

A home loan is essentially a financing option where funds are provided to an individual or an entity for the purchase, construction, extension, or renovation of a residential or commercial property. Lenders provide funds upfront, and borrowers repay through monthly installments, usually over many years. It's crucial for prospective homeowners to understand the terms, interest rates, tenure, and eligibility criteria before applying.

How do I apply for a home loan?

You can apply for a Home Loan with ICICI Bank through multiple ways. Steps for each are listed below:

1. iMobile App

- Log into the iMobile app

- Click on the ‘Instant Loans tile under the ‘Transact’ tab

- Scroll and search for your Home Loan

- Customise your Loan amount and fill in the information in the relevant fields

- Proceed to fee payment.

2. Internet Banking

- Log into your Internet Banking account

- Go to the ‘Loans’ section

- Click on the ‘Home Loan’ tile

- After getting redirected, enter the required details and proceed ahead to pay the login fee.

For new customers of ICICI Bank

1. Apply Online

- Click here to visit the ICICI Bank Home Loan portal and enter your desired loan amount and tenure

- Provide necessary information like your PAN, Date of Birth and Aadhaar Number

- Read and accept the disclaimer and verify through OTP to complete the KYC

- Select the loan option as per your financial requirement and proceed

- Adjust the loan terms as per your financial standing

- Provide additional details like income and property information

- Pay the processing fee and submit.

The loan is provisionally sanctioned to your Account after the verification is complete.

2. Visit a Branch

Loan applications can also be made offline. Visit any ICICI Bank Branch to apply for the loan in person. Fill out the application form with standard paperwork and submit the application for approval.

What are the parameters for arriving at Home Loan eligibility?

- Age:

- 21–65 years for salaried individuals

- 21–70 years for self-employed individuals

Income:

- ₹ 25,000 per month as minimum salary

- ₹ 30,000 per month as minimum income for a self-employed individual

- Employment Stability: A steady employment record or a steady track record of business

Housing Loan Value Added Services

Explore ICICI Bank’s unique Home Loan solutions

Apply for Home loan

at your convenience

- Mobile Banking

- Net Banking

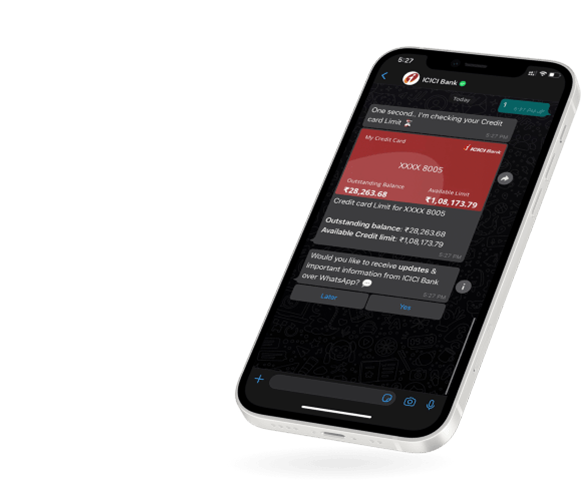

- WhatsApp Banking

Apply for Home loan

at your convenience

Mobile Banking | Net Banking

WhatsApp Banking