Education Loan Interest Rates Eligibility

| Interest Rates | Information |

|---|---|

[REPORate + 3.75%(Spread)] onwards |

|

Unsecured Loan Amount – Up to ₹ 1 Crore |

|

| Particulars | Eligibility |

|---|---|

Nationality |

Indian |

Age |

Minimum - 16 years and Maximum - 35 years |

Academic record |

Proven - good |

Qualification |

Completed 10+2 (12th Standard)/Diploma |

For Pursuing |

Graduation/Postgraduate Degree or a PG Diploma in Professional Education |

Mandatory documents for an Education Loan

Apply for an Education Loan online in 5 quick steps

- 01.Scan the QR code and fill the basic details

- 02.Application submission

- 03.Document submission

- 04.Loan assessment

- 05.Sanction Letter , Disbursement.

How to Apply For an Education Loan

Education Loan FAQ

What is an Education Loan?

An Educational Loan assists students in funding their studies by covering expenses such as tuition fees, books and other educational costs.

Who can apply for an Education Loan?

Students who have secured admission in National Assessment and Accreditation Council (NAAC) accredited Universities/Institutions, National Board of Accreditation (NBA) recognised professional courses, Centrally Funded Technical Institutes or all other recognised International Universities/Institutions can apply for an Education Loan.

How can I apply for an Education Loan?

You can apply through our website or you can visit any ICICI Bank branch or apply through the VidyaLakshmi portal link.

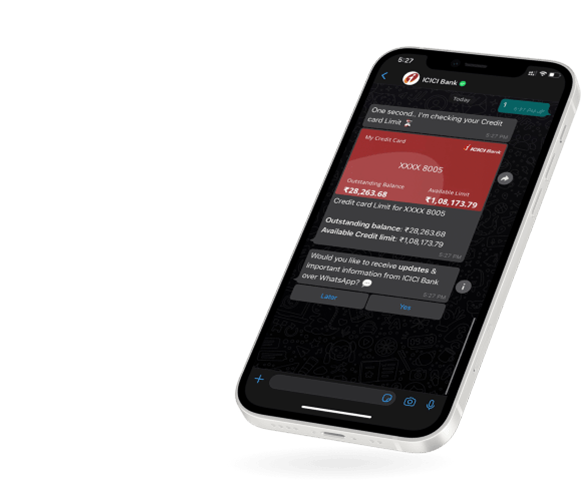

Apply for Educational loan

at your convenience

- Mobile Banking

- Net Banking

- WhatsApp Banking

Apply for Educational loan

at your convenience

Mobile Banking | Net Banking

WhatsApp Banking