How to open a Recurring Deposit with ICICI Bank?

- 01. Choose your preferred language

- 02. Press ‘1’ for existing customers and then ‘1’ for banking accounts

- 03. Enter your Debit Card number and PIN to speak with our team

- 01. Visit any ICICI Bank Branch

How to Create RD on iMobile

How to Create RD on Internet Banking

Documents Required to open an RD

FAQs about Recurring Deposit for NRIs

What is a Recurring Deposit?

A Recurring Deposit (RD) is a disciplined way to invest small amounts each month and build a substantial sum till maturity

What happens to the proceeds on maturity?

On maturity, the proceeds will be credited to your Savings Account with ICICI Bank.

Is there a penalty for delayed payments for NRE Recurring Deposits?

A penalty of ₹ 12 per ₹ 1000 for every instalment will be levied for delayed payments towards RDs.

Invest Anywhere,

Anytime

Mobile Banking | Internet Banking

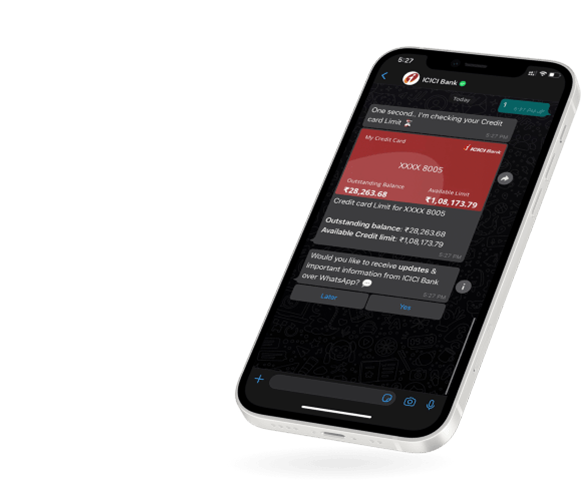

WhatsApp Banking