Don’t have an ICICI Bank Current Account? That’s okay.

Avail the best-in-class business banking solutions even without having an ICICI Bank Current Account. Log in as a ‘Guest User’ and avail multiple offers to kick-start your business growth journey.

Manage your Current Account

Stay updated 24x7 on your business transactions

- View your account balance and bank statements

- Open and manage your FD online

- Track deliverables

- Manage approvals

- Open a Current Account instantly

Start instant collections with our MERCHANT SERVICES

Payments were never simpler.

- Instant settlements & voice alerts for all ICICI Bank QR transactions

- Point of Sale (POS) terminals for merchants

- Online payments via payment links and payment gateways

- Collect through UPI Intent and Collect Request

- Lending options provided based on your transactions

- Manage all merchant products and services at one place - InstaBIZ Merchant Dashboard.

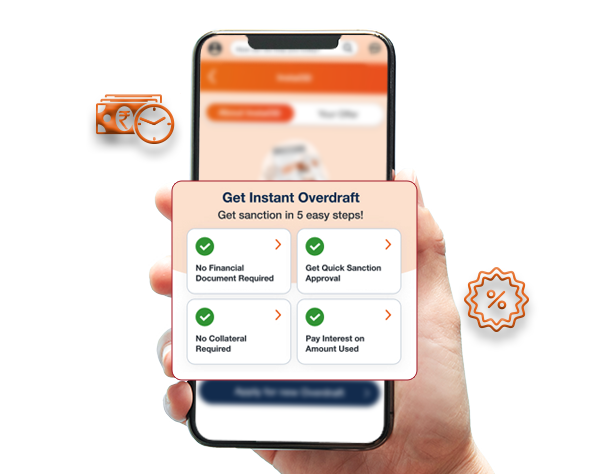

Grow your business with Instant Overdrafts & Business Loans

Hassle-free access to loans.

- Loan offers for instant OD

- Secured Working Capital Loans

- Overdraft on an ICICI Bank Fixed Deposit

- Loan application tracker

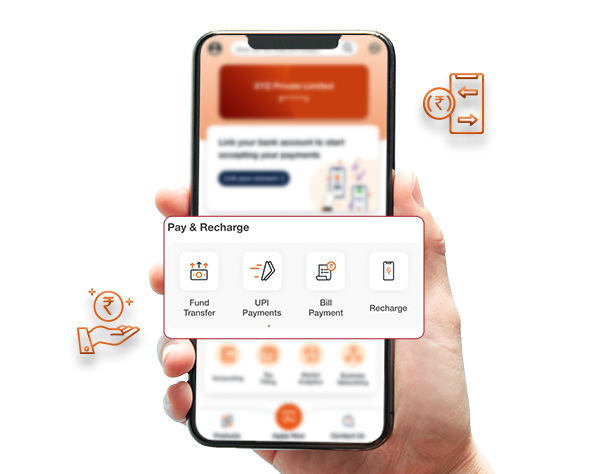

Manage all your payments & collections

Enabling seamless payments & collections.

- Collect single invoice via link/QR

- Easy reconciliation with ERP integration

- Maker-checker facility for easy workflow

- Virtual Account collection

Carry out Export-Import transactions with ease

Round-the-clock Export-Import Banking.

- Settle Inward Remittances & initiate Outward Remittances

- Instantly convert EEFC Account balances into INR

- Regularise Bill of Entry

- Apply for Bank Guarantees

- Initiate Export Bill Regularisation

- Activate Trade Online – a comprehensive digital portal for all your trade transactions

- Trade Emerge – explore value-added services

Manage your daily banking needs in just a few clicks

Enjoy instant payments on the go:

- Log in to multiple accounts with a single MPIN

- View balance & statements of any bank account using iFinance

- Quick fund transfer of up to Rs 20,000 without adding Payee

- Pay bills, recharge FASTag & book travels using UPI/QR

- Enjoy flexibility with multiple payment modes- Fund Transfer, UPI, Pay to Mobile

- Set payment reminders & auto-pay for bill payments

- Instant e-gift cards across categories like fashion, food, beauty and more

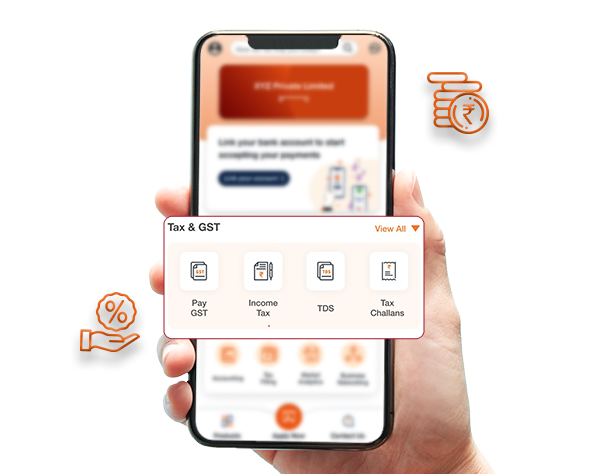

Never miss a tax payment deadline

Pay tax online in a few simple steps

- Make GST payment

- View & download tax challan/s

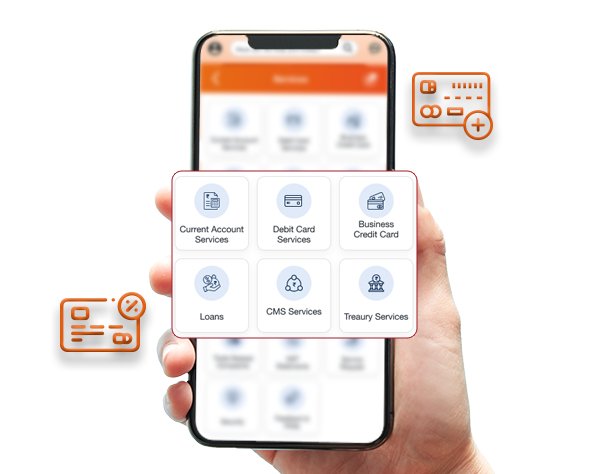

MANAGE BANKING SERVICES AT YOUR CONVENIENCE

Avail services anytime, anywhere.

- Order and manage cheque payments

- Order RTGS booklet

- Apply for and manage your Debit Card

- Update your address and nominee details

- Apply for Banker’s & Solvency Certificates.

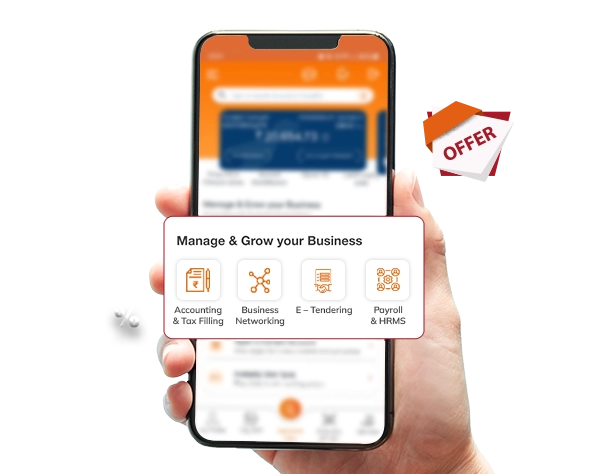

Banking +

Special discounts & offers on our partner platforms to scale your business

- Accounting & tax filing – Zoho, LEDGERS, Bank Plugin

- Business networking – BizCircle

- Payroll & HRMS - greytHR

- E-tendering - Tata Nexarc

Scroll to top

Security is our priority

Two-factor i-safe authentication

Role-based access: Maker/Approver

End-to-end 256-bit encryption

3 simple steps to start

Using InstaBIZ app

Download the InstaBIZ app

Activate the InstaBIZ app

Authenticate

& Log in

1.8 M+

App Downloads

4.6/5

Ratings

24K+

Reviews

Frequently Asked Questions (FAQs)

InstaBIZ is a business banking mobile app that provides all services under one roof to help customers with their business requirements. They can apply for an Overdraft, make payments, order a chequebook and do a lot more with the app anytime, anywhere. This app is now available for all ICICI Bank and non-ICICI Bank customers.

Steps to use the InstaBIZ app:

For existing ICICI Bank Current Account customers:

- Download the app

- Set up login credentials

- Authenticate using the OTP sent to your registered mobile number.

For non-ICICI Bank customers:

Download the app and register as a ‘Guest User’.

Existing ICICI Bank Current Account customers can make payments using InstaBIZ through multiple modes:

NEFT, RTGS and IMPS:

Go to ‘Fund Transfer’ > ‘Register a Beneficiary’ > ‘Authenticate’ > Enter amount > ‘Proceed’.

UPI option available on the InstaBIZ dashboard or by using quick fund transfer (for payments up to Rs 20,000 per day):

Go to ‘Fund Transfer’ > Enter ‘Payee details’ > ‘Authenticate’ > ‘Proceed’.

Customers can use the InstaBIZ app for:

- Payments

- Trade services

- Merchant collections

- Debit Card transactions

- Cheque related services

- Cash management services and much more.

Download the app now and start experiencing the all-in-one business banking app.

No. ICICI Bank does not charge a fee for using the InstaBIZ app. Your telecom operator may charge a fee for data usage (internet browsing) or for the SMS service on your mobile device.

A ‘Guest User’ can avail the following services on the InstaBIZ app:

Link any bank account to start transacting

Access Merchant Services

Instant merchant onboarding for POS/ UPI/ QR

Instant Overdraft

Open a Current Account instantly

Trade Emerge platform for all export-import transactions.

Yes, the InstaBIZ app is completely secure with end-to-end encryption and single/ dual authorisation using grid value and OTP, ensuring that all transactions are protected.

Yes, role-based access allows log in as either a ‘Maker’ or a ‘Checker’. A ‘Maker’ can raise an approval request and a ‘Checker’ can approve the request using the InstaBIZ app.