Car Loan Eligibility

ICICI Bank Car Loan eligibility criteria for diverse applicants.

- Salaried individuals must be aged between 20 and 65 years with a minimum monthly income of Rs 30,000.

- Self-Employed individuals must be aged between 21 and 70 years. An existing relationship with ICICI Bank is advantageous.

Car Loan Interest Rates

ICICI Bank offers easy Car Loans at competitive interest rates. You can take advantage of these rates to get your dream car with manageable monthly payments.

Loan Type |

Tenure (12-35 months) |

Tenure (36-84 months) |

|---|---|---|

New Car Loans |

10.20%* onwards, based on CIBIL Score and Car Segment. |

9.10%* onwards, based on CIBIL Score and Car Model. |

11.25%* onwards, based on CIBIL Score and Car Segment. |

||

Car Loan Documents

ICICI Bank simplifies Car Loan applications with a clear and comprehensive Car Loan Documents List. Summary of the documents is given below:

- KYC details

- Address proof

- Income evidence

- Proof of business or employment stability

Salaried individuals need recent Salary Slips whereas self-employed applicants must provide Financial Statements or Income Tax Returns. This streamlined process ensures a quick and stress-free Car Loan application process.

Apply for Car Loan in 4 steps

Car Loan Products

Begin your car search today

Use our car comparision tool to help you decide which vehicle best meets your needs and purchase it

Benefits of ICICI Bank Car Loan

Car Loan FAQs

What is a Car Loan?

Car Loans are extended for the purchase of a passenger four-wheeler, new car or a pre-owned car. Car Loans can also be used as a Cash Loan through products like Refinance, Top-up on an existing Car Loan or to carry out a Balance Transfer.

How is a Car Loan application processed?

There are two types of application processes when applying for a Car Loan – a Digital process and a Manual process.

Manual Process

- Walk in.

- Have a discussion with our team.

- The team will share Schemes and Internal Rate of Return details.

- Submit the required documents.

- The team will follow the internal approval process.

- Post-approval, the Loan will be disbursed.

Digital Process

- Visit the ICICI Bank website, navigate to the Car Loan application page, and click on ‘Apply Now’.

- Choose Existing or New Customer.

- Select the Loan Type and provide details such as name, mobile number, work information, etc.

- Once this is done, you will get an overview of your Loan eligibility.

- Complete the Car Loan Application Form.

- Upload digital copies of the required documents.

- The application and the documents will be verified electronically.

- Receive an approval notification from ICICI Bank.

- The Loan amount will be disbursed directly to the seller.

Can I get 100% funding to buy a car?

Yes, Pre-approved customers can avail 100% of the on-road price. However, the on-road price should be equal to or less than the offer amount. For Non-Pre-approved customers, 100% on-road funding on Vehicle Loans is possible based on parameters like income, stability, FOIR, CIBIL and internal checks.

Apply for a Vehicle Loan at

your convenience

- Mobile Banking

- Net Banking

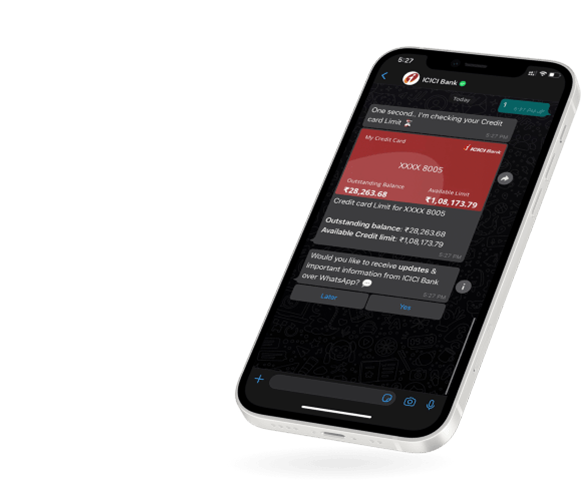

- WhatsApp Banking

Apply for a Vehicle Loan at

your convenience

Mobile Banking | Net Banking

WhatsApp Banking

Hold on, you're almost there!

You are just a few clicks away from your dream car.