Indian Economic Update

- The Government estimates have pegged Gross Domestic Product (GDP) growth at 5.0% YoY for FY2020, expected to moderate sharply from the 6.8% YoY seen in FY2019, and in line with market expectations. A deceleration in consumption, investment and a decline in exports is expected to weigh on headline growth for this year.

- Private consumption growth is expected to moderate to 5.8%. Gross fixed capital formation is expected to be anaemic at 1% YoY this fiscal. Exports are expected to show a minor contraction.

- Gross Value Added (GVA) growth is also seen moderating to 4.9% YoY in FY2020 from 6.6% YoY in FY2019.

- Core GVA growth (non-agriculture non-government spending growth) is expected to plunge to 4.6% YoY in FY2020 from a robust 7.0% last year, showing that much of the impetus to growth is being sustained by the Government’s expenditure push.

- Industry growth is expected to take a sharp hit, decelerating to 2.5% YoY from 6.9% YoY in FY2019.

- Services sector of the Indian economy is expected to lose some traction sequentially this fiscal, as slow consumption, a tedious financial sector clean up, and low offtake in real estate are expected to outweigh robust Government spending.

Global Update

- The killing of a top Iranian military general in a US air strike led the Iranian government to retaliate as it launched a dozen military missiles targeting two US-Iraqi bases this week.

- The U.S. House of Representatives voted Thursday to limit President Mr Donald Trump’s authority to strike Iran, in a mostly symbolic move. The resolution was adopted on a 224-194 vote.

- U.S. President Mr Donald Trump on Thursday said his administration will start negotiating the Phase 2 U.S.-China trade agreement soon but that he might wait to complete any agreement until after November’s U.S. Presidential Election.

- China's finance ministry will allow local governments to front-load more than CNY 500 billion worth of general purpose bond issuance intended to be used up before March, according to the sources.

- Moodys has warned that growth slowdown might be exacerbated in 2020 by US-China trade tensions, despite phase one trade deal and has forecast GDP growth of 4.0% in 2019-2021 on average across Asia-Pacific.

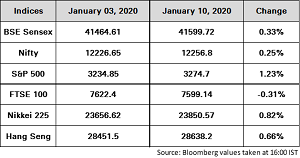

After weakening during the first half of the week, Indian equity markets ended higher amid easing geopolitical tensions between US and Iran.

During the week Sensex gained 0.33% to close at 41599.72 while Nifty advanced 0.25% to close at 12256.8.

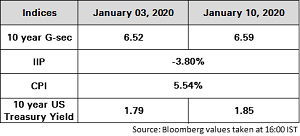

Indian Government bonds had weakened during the beginning of the week due to rise in crude oil prices and weakness in rupee. However, it gained strength as tensions between the US and Iran eased.

The 10Y benchmark yield ended at 6.59% as compared to the previous week’s close of 6.52%.

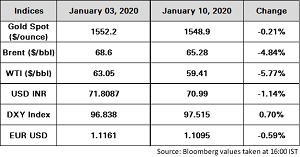

Oil prices reacted to the killing of a top Iranian military leader in a US air strike, causing Brent to cross the USD 70/barrel level for the first time since the attack on Saudi oil facility in Sep 2019.

Gold prices moved to a near seven-year high crossing the USD 1,600/ounce mark on severe risk aversion due to escalating tensions between the US and Iran. Although a de-escalation has eased gold prices at present, the evolving geo-political developments need to be watched ahead.

Geopolitics has roiled the Indian Rupee lately, with the USD/INR depreciating to 72.11 levels before recovering somewhat.

The Dollar index built on its gains as the pound weakened sharply on dovish remarks from the Bank of England (BoE) governor.

USD/JPY pair inched higher amid an improvement in geo-political tensions between US and Iran.

The Euro was trading flat against the dollar.

Source: ICICI Bank Research, Private Banking Investment Strategy Team, Bloomberg and CRISIL.