Indian Economic Update

- The International Monetary Fund (IMF) projects global growth to rise from an estimated 2.9% YoY in 2019 to 3.3% in 2020 and 3.4% in 2021. The new projections represent a downward revision of 0.1 percentage point for 2019 and 2020, and 0.2 for 2021 compared to those made in the October forecasts.

- The IMF also lowered India’s Gross Domestic Product (GDP) growth projections from 6% YoY to 4.8% for 2019 and from 7% to 5.8% for 2020.

- The Reserve Bank of India (RBI) on Jan 23 raised the investment limit for Foreign Portfolio Investments (FPI) in government and corporate bonds. According to the current norms, short-term investments by a foreign portfolio investor should not exceed 20% of the total investment of that FPI in either central government securities or state development loans. This short-term investment limit has been increased from 20% to 30%.

- The government, on Thursday, asked the Department of Telecommunications (DoT) not to take any coercive action against telecom companies for non-payment of Adjusted Gross Revenue (AGR) dues until further court orders.

Global Update

- US President Mr Trump expressed confidence that the US will reach a new trade agreement with Europe, arguing that leaders in the region have “no choice” but to make a deal amid the threat of auto tariffs. In response, Germany's ambassador to the US, Ms Emily Haber said, the European Union could also impose duties on US products.

- The European Central Bank (ECB) Governing Council said in a statement that the Eurozone base interest rate will remain at 0.00%, with the marginal lending rate and deposit rate remaining at 0.25% and minus 0.50%.

- The Bank of Japan left rates unchanged and painted a brighter picture of the economic outlook, offering indication that the likelihood of additional stimulus has receded.

- Chinese officials halted travel from Wuhan, essentially locking down the city of 11 million people as they try to stop the spread of the coronavirus, which has already infected hundreds and claimed 17 lives.

- The Bank of Canada maintained status quo. However, it cut its GDP growth forecasts. It also provided strong indications that it could be open to cut rates if the economy continues to show persistent weakness.

- US President Mr Donald Trump’s impeachment trial began on Tuesday.

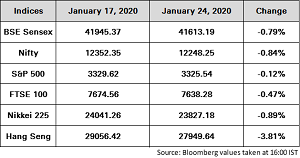

Indian equity markets ended lower in line with the weakness in world equities, after the IMF slashed its growth outlook for India.

During the week Sensex lost 0.79% to close at 41613.19 while Nifty declined 0.84% to close at 12248.25.

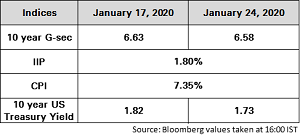

Indian Government bonds ended higher, as cut-off price at special Open Market Operation (OMO) auction was higher-than-expected. RBI sold INR 30 billion worth of bonds maturing in 2021 as against INR 100 billion notified. Cut-off for 7.32%, 2024 bond set less-than-expected.

The 10Y benchmark yield ended at 6.58% as compared to the previous week’s close of 6.63%.

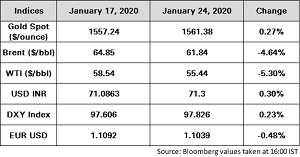

Crude oil slumped nearly 3% on Wednesday on concerns of oversupply as the International Energy Agency (IEA) forecast a surplus. Mr Fatih Birol, the agency head, said on Wednesday he expects a surplus of 1 million barrels per day in the first half of 2020.

Gold is trading stronger as investors are hedging against lingering tensions in Middle East and an impeachment trial in Washington. However, gains were capped due to stronger Dollar index because of positive US data.

The Indian Rupee ended slightly weaker against the Dollar as global risk aversion after IMF cut India's FY2020 growth forecast by 130 bps that weighed on the domestic currency.

The Dollar Index (DXY) has remained fairly range bound trading in the 97.50 range as investors respond to news on the coronavirus.

Risk aversion remains prominent reflecting in the weakness in global equity markets supporting safe-haven currencies in the process.

The EUR/USD pair has weakened after the ECB kept rate unchanged.

The USD/JPY pair has remained flat. The Japanese trade balance showed some improvement reflecting a sharp fall in the imports bill indicating that domestic demand remains weak, but the release had a limited impact on influencing the JPY.

Source: ICICI Bank Research, Private Banking Investment Strategy Team, Bloomberg and CRISIL.