Indian Economic Update

- The Indian government is set to release the Economic Survey for FY2020 on Friday, which is considered to be a pre-cursor to the Budget.

- India’s first coronavirus infection was confirmed in Kerala on Thursday. The World Health Organisation (WHO) declared the coronavirus outbreak a public-health emergency of international concern.

Global Update

- The Federal Open Market Committee (FOMC) maintained status quo on policy rates and its balance sheet strategy that was on expected lines. While there was the annual rotation of voting members that takes place in the new year, the decision was unanimous.

- There was a small technical adjustment that was made as the Interest On Excess Reserves (IOER) was raised by 5 bps to 1.60%. The hike in IOER was done to raise the effective fed funds rate towards central band of the target fed funds range of 1.5%-1.75%.

- US President Mr Donald Trump on Wednesday signed the US-Mexico-Canada (USMCA) trade agreement. Mexico has already approved the deal, but it must be ratified by Canada’s parliament before it can take effect.

- Italy’s Mr Matteo Salvini suffered a defeat in a key regional vote, providing a boost to Prime Minister Mr Giuseppe Conte’s fragile government and making a snap general election less likely.

- The Bank of England (BoE) opted to maintain status quo and resort to a wait-and-watch mode. The MPC voting pattern remained at 7-2.

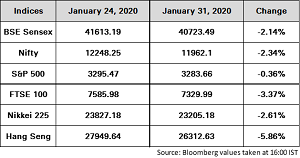

Indian equity markets ended lower, tracking weakness in Asian peers as worries about the economic impact from the coronavirus in China continued to weigh on the sentiment.

During the week Sensex lost 2.14% to close at 40723.49 while Nifty declined 2.34% to close at 11962.1.

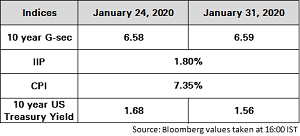

Indian Government bonds remained stable, on hope of RBI announcing fifth round of special OMOs. Concerns about the Centre's weak finances capped the gains, especially ahead of Budget.

The 10Y benchmark yield ended at 6.59% as compared to the previous week’s close of 6.58%.

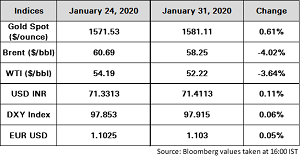

Oil is trading weaker as worry about the impact of coronavirus on world’s second biggest economy rattled markets. Algeria’s energy minister said that Organisation of Petroleum Exporting Countries (OPEC) meeting could be advanced to February instead of the scheduled meeting in March. The bigger than expected build in US crude oil inventories last week also kept pressure on prices.

Gold is trading largely flat as coronavirus fuelled risk off sentiment, pushing investors into safe havens. A Chinese government economist reported that China’s economic growth may drop 5% or lower due to outbreak.

The Indian Rupee ended lower against the Dollar as concerns over spread of coronavirus weakened risk appetite. Global strength in the greenback also weighed on the Rupee.

The DXY has moved lower as markets digest the outcome of the FOMC meeting, some improvement in Euro-zone economic indicators and the BoE maintaining status quo.

The EUR/USD pair traded marginally higher.

Source: ICICI Bank Research, Private Banking Investment Strategy Team, Bloomberg and CRISIL.