Indian Economic Update

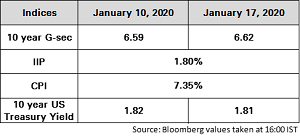

- India Consumer Price Index (CPI) inflation came in higher than expectations at 7.35% YoY in Dec 2019 versus 5.54% YoY in Nov 2019, driven primarily by a sharp spike in food inflation and upward momentum in miscellaneous basket led by surge in telecom tariffs.

- Food inflation jumped up to 14% YoY versus 10% YoY. This was primarily on account of surge in vegetable prices (with onions adding approximately 210 bps to headline numbers) which saw a sharp sequential spike of 8.72% MoM.

- Core inflation came at 3.73% YoY (similar to our expectations), compared to 3.5%.

- Wholesale Price Index (WPI) inflation also rose to 2.6% YoY in December from 0.6% YoY in November.

- Headline Index of Industrial Production (IIP) growth surprised sharply to the upside, printing at +1.8% YoY in November, arresting the contractionary streak seen over the previous three months.

- Manufacturing output significantly improved to clock a four-month high, aided by a very favourable base. 13 of 23 industry groups showed positive growth.

- Trade deficit for December remained contained at USD 11.3 billion on a low import bill, but exports continued in the red. However, some core components of exports and imports showed sequential recovery.

- Export contraction continued for the fifth consecutive month to clock -1.8% YoY in December, partly hampered by an unfavourable base. Import contraction narrowed in December, coming in at a six-month low, aided by a low base, and given some marginal uptick in domestic demand. Non-oil non-gold imports continued to contract for the seventh consecutive month.

- Mr Michael D Patra has been appointed Deputy Governor of the Reserve Bank of India (RBI).

- The RBI announced that it will continue with its ‘operation twist’ programme by announcing another INR 100 billion that will be conducted on Jan 23, 2020. The Indian Government announced a switch of securities of INR 250 billion.

Global Update

- After eighteen months of negotiations, US-China were able to reach a limited phase one trade deal that at least shows that some progress has been made.

- The trade deal highlights agreement on areas such as Chinese purchases of US goods and services, Chinese financial sector, technology transfer, US agricultural goods, a currency accord and an enforcement mechanism. The US for its part has maintained its modest easing in tariffs on Chinese imports but still has tariffs in place on two-thirds of the Chinese import basket.

- Phase two negotiations are also due to commence but will only conclude after the US has had a chance to review the performance of China with respect to phase one.

- The US Treasury lifted its designation of China as a currency manipulator.

- After increasing sharply in November by 256,000, US payrolls growth moderated to its trend pace of approximately 145,000 in December. The unemployment rate remained unchanged at 3.5%, reflecting a still tight labour market.

- Iran admitted that it accidentally shot down Ukrainian airliner, which killed all 176 people on-board.

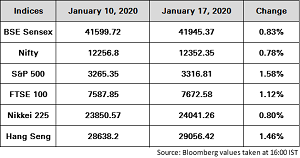

Indian equity markets ended higher after US and China signed the first phase of a trade deal, though weakness in metal and mining stocks capped gains.

During the week Sensex gained 0.83% to close at 41945.37 while Nifty advanced 0.78% to close at 12352.35.

Indian Government bonds ended lower as surge in December CPI and WPI inflation dampened hope of RBI rate cut. Switch between government and RBI on Monday dented hopes of more special open market operations.

The 10Y benchmark yield ended at 6.62% as compared to the previous week’s close of 6.59%.

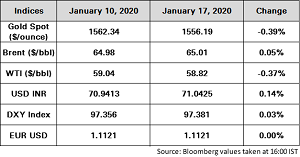

Oil is trading weaker as industry data showing an increase in U.S. crude stockpiles and re-affirmed expectations that global markets will be oversupplied in the first part of the year. International Energy Agency (IEA) in its short-term energy outlook has noted that decline in drilling rigs over the past year could result into slowing crude oil production growth and this trend is expected to continue into 2020.

Gold is trading largely flat as interim trade deal between US and China boosted investors risk appetite, although concerns remain about whether the targets set will be achieved and the fact that tariffs have been reduced by a degree not eliminated are still supporting the non-yielding bullion.

The Indian Rupee traded weaker against the Dollar amid rise in Brent crude oil prices. Comments by US Vice President Mr Mike Pence that "phase-two" trade talks have begun lifted risk appetite.

Dollar index continues to trade with a downside bias, reflecting risk-on sentiment as investors respond favourably to the signing of the phase-one trade deal between US and China.

The EUR/USD pair moved higher mirroring the move seen in the CNY/USD pair.

GBP/USD pair has moved lower primarily reflecting some position adjustment as investors respond to the risk-on sentiment in the global markets.

The effect of reduced concerns about US-China has pushed the USD/JPY pair higher as global equity markets have rallied on a broad basis.

Source: ICICI Bank Research, Private Banking Investment Strategy Team, Bloomberg and CRISIL.