Finance available for all Commercial Vehicles

Get financial help with all kinds of vehicles such as trucks, buses, tippers and other light commercial vehicles.

Working Capital

Our working capital loan will ensure that you meet all your business needs.

Extended Products

Get funding for new vehicles, finance on used vehicles, top up on existing loans as well as working capital loans to keep your business going.

Preferred Financier Status

ICICI Bank’s Preferred Financier status with all leading manufacturers makes the vehicle buying process easier.

Presence throughout India

With a presence in 400+ locations across India, getting a commercial loan is easy.

- Any individual/ partnership firm/ company with more than two years of business experience.

- Existing owner of at least two commercial vehicles.

- Captive customers and transporters

- Specific interest rate applicable to a customer would be based on factors such as customer profile, relationship and tenure of loan etc.

- Stamp duty charges shall be extra as applicable

- Additional documentation charges of Rs 350 applicable

- ICICI Bank reserves the right to revise the rate of interest and processing fee from time to time, at its sole discretion

For more information, please visit the nearest ICICI Bank branch or call our Customer Care

The Annual Percentage Rate (APR) is a method to compute annualized credit cost which includes interest rate and loan origination fee.

To calculate the same, please click here to download the APR calculator.

- Mobile Banking

- Net Banking

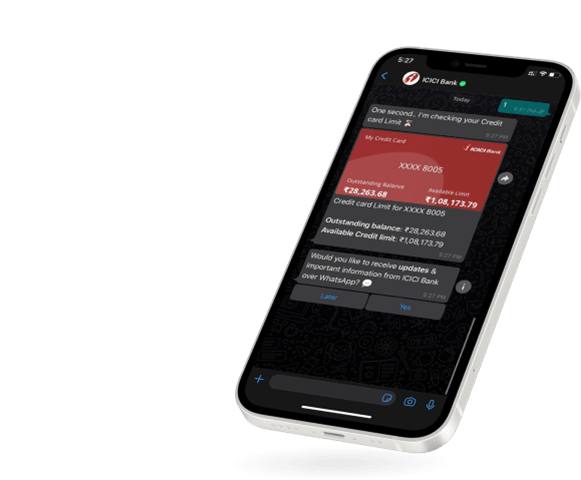

- WhatsApp Banking

Quick tips and helpful product demonstration videos - ICICI Bank Online Demos & Videos

Explore Now

Top-up your

health cover

with ICICI Lombord

Group Health Insurance