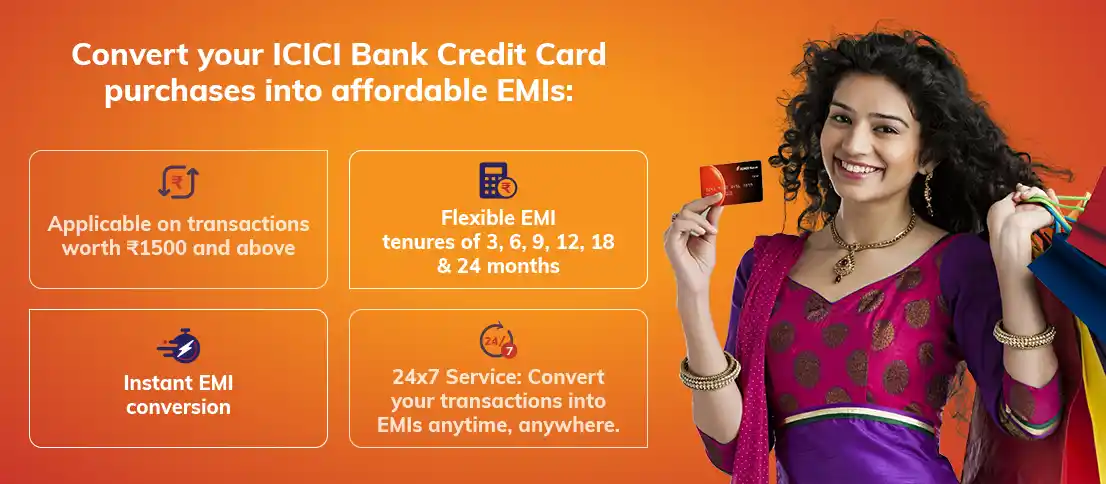

Features of ‘EMI on Call’ facility

- Transactions of ₹ 1,500 and more can be converted into EMIs through the iMobile app, Internet Banking, WhatsApp Banking and ICICI Bank Customer Care under the ‘EMI On Call’ facility.

- Transactions of ₹3,000 and more can be converted into EMIs, through the 3D Secure page/OTP page under the ‘EMI On Call’ facility.

- Convert your transactions into EMIs and pay interest at the rate of 1.5% per month on a monthly reducing balance basis and enjoy a lower rate of interest than the revolving rate you would normally pay on your Credit Card.

- A one-time Processing Fee of 2% of the transaction value is charged at the time of EMI conversion.

- Gold, jewellery, fuel purchases, gambling and cash transactions won’t be eligible for EMIs.

- Transactions older than 30 days cannot be converted into EMIs.

How to avail the ‘EMI on Call’ facility?

Through digital modes:

iMobile app:

- Step 1: Log in to ICICI Bank iMobile app

- Step 2: Click on ‘Cards & Forex’ and select your Credit Card

- Step 3: Click on the ‘Manage Card’ section

- Step 4: Select ‘Convert to EMI’ from ‘More Options’

- Step 5: Select the Credit Card Number from the dropdown & select the transaction

- Step 6: Choose a convenient tenure for the EMIs and click on ‘Submit’.

WhatsApp Banking

- Send a message with the keyword ‘Hi’ on (+91 86400 86400) through WhatsApp

- Click All Services > Credit Card Services > Convert Txn to EMI > Select Credit Card > Select Transaction for EMI Conversion > Select EMI Plan/ Tenure > Click on ‘Confirm’ > Enter the OTP sent to your Registered Mobile No. > Enter last 4-digits of PAN.

Internet Banking:

- Step 1: Log in to ICICI Bank Internet Banking

- Step 2 : Go to Credit Cards under the ‘Cards & Loans’ section and click on ‘Convert to EMI’.

- Step 3 : Choose the card and click on ‘Submit’

- Step 4 : Select the transactions, click on calculate EMI, select EMI tenure and acknowledge on T & C and click on ‘Convert to EMI’.

Through 3D Secure/ OTP Page:

- Credit Cardholders can opt for converting an online transaction into EMI, with plans for 6, 12 and 24 months on the 3D Secure/ OTP page

- Select ‘Tenure’, read & click on the ‘T&Cs’ checkbox, enter the OTP and click on the ‘Submit’ button to opt for EMI conversion

- EMI will be converted within <4> working days.

Third Party applications for UPI on Credit Card Transactions

- Log in to the Third-Party application and go to the ‘History’ page

- Select the ‘UPI on Credit Card’ transaction that needs to be converted to EMI

- Choose a convenient ‘EMI Plan’

- Provide consent and enter the PIN to avail the EMI.

Through voice modes:

Customer Care:

- Call our Customer Care on 1800 1080 and get the eligible transaction converted to EMI.

Missed Call/ Transaction Alert SMS:

- Give a missed call on 9537667667 from your Registered Mobile Number

- On receiving your request through a missed call, our representative will call you within two working days and explain the details related to EMI charges before the EMI Conversion.